Get In Touch

Please fill out the form below if you have a plan or project in mind that you'd like to share with us.

Follow Us On:

Unveiling the Role of Fintech Software Development Services

In the rapidly evolving landscape of finance, the demand for cutting-edge solutions has led to the emergence of specialized firms known as fintech software development agencies. These companies play a pivotal role in reshaping the financial industry by creating innovative and tailor-made financial software development services.

A fintech software development agency is a dynamic hub of technological expertise that collaborates with financial institutions and startups to build advanced solutions. These solutions encompass a wide array of services, including financial software development, finance services development, and specialized tools that address specific challenges within the financial sector.

Unlike traditional software development, fintech software development requires a deep understanding of financial intricacies and regulatory frameworks. Fintech software development companies employ professionals who possess both technical prowess and financial domain knowledge. This unique combination enables them to design and build software that not only meets industry standards but also complies with stringent financial regulations.

Fintech Software Development Agency Insights

The scope of services offered by fintech software development agencies is extensive. They can create robust payment processing systems, secure mobile banking applications, algorithmic trading platforms, blockchain-based solutions for transparent transactions, and robo-advisors for automated financial planning. These services empower financial institutions to enhance operational efficiency, reduce risks, and provide seamless user experiences.

Collaborating with a fintech software development company brings forth a multitude of benefits. Firstly, it enables financial businesses to stay ahead of the competition by adopting the latest technological trends. Secondly, it fosters innovation by leveraging technologies such as artificial intelligence, machine learning, and data analytics to derive valuable insights from vast financial datasets.

Reshaping the Future of Finance: How Fintech Software Development Companies Drive Change

Moreover, fintech software development agencies assist in bridging the gap between traditional financial services and the digital world. They facilitate the transition from conventional banking to digital banking, ensuring that customers can access financial services with ease and security.

The Sector of fintech software development services is a thriving sector that plays a pivotal role in revolutionizing the financial industry. These agencies combine technological expertise with financial domain knowledge to create bespoke solutions that drive efficiency, compliance, and innovation. As the financial landscape continues to embrace digital transformation, fintech software development remains a cornerstone of this evolution.

Custom Accounting Software Development

Marthub custom accounting software development services include API programming & integrations, AIS architecture, bookkeeping app development, and much more.

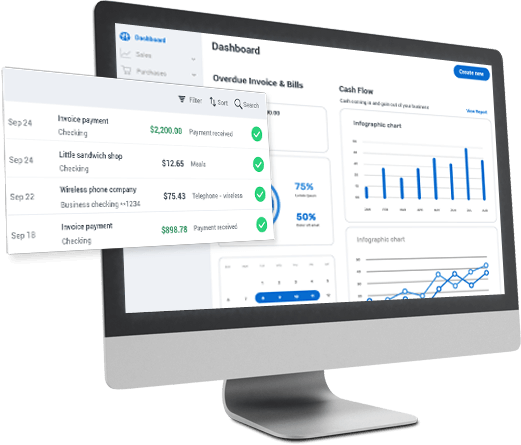

Accounting Information Systems

Developers engineer online accounting software and AIS architectures integrated with ERP, CRM, asset tracking, vendor management, and other financial management programs.

Mobile Accounting Applications

We offer responsive cross-platform and native development of mobile accounting apps programmed to provide full access to operational accounting workflows.

Invoicing & Accounts Receivable

Accounts payable and receivable software modules automatically upload inventory spreadsheets, create downloadable purchase orders, generate reports, and more.

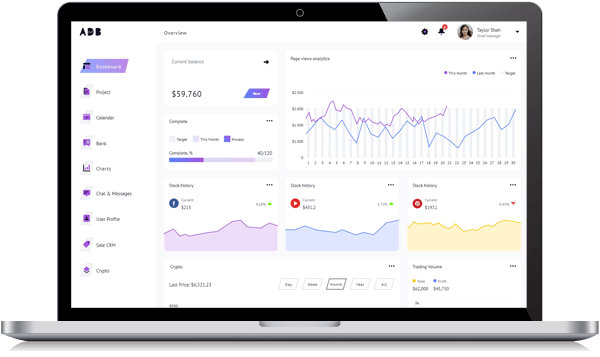

Portfolio Management Dashboards

Develop PM dashboards with built-in asset management modules and integrated ticker symbol databases, trade algorithms, historical data analysis tools, and more.

Investment Data Integrations

Program data entry forms and tools for standard investment files QIF, OFX, QFX, and CSV, plus accounts from TD Ameritrade, E*Trade, Vanguard, and other major brokerages.

Risk Management & Analysis

Offer third-party risk mitigation solutions that include multi-factor risk modeling and stress scenario testing to identify and assess high-risk financial investments and contingencies.